MONTHLY PREMIUM FORECASTER

Insurance - Optimizing Profit through the Future Premium Predictor

Insurers are facing challenges in achieving their profitability targets. The majority of insurance carriers are now a days focusing on retention of customers rather than growth as the investments in retention can deliver better returns than investments in acquisition.

However, a general increase in premiums do not yield desired effect, neither in terms of retaining customer, nor in terms of overall portfolio profitability. The carriers need deeper analyses of their portfolios and need to adjust pricing for individual customer based on risks projected over time for their segment, subsequently increasing overall account profitability.

Solution Overview

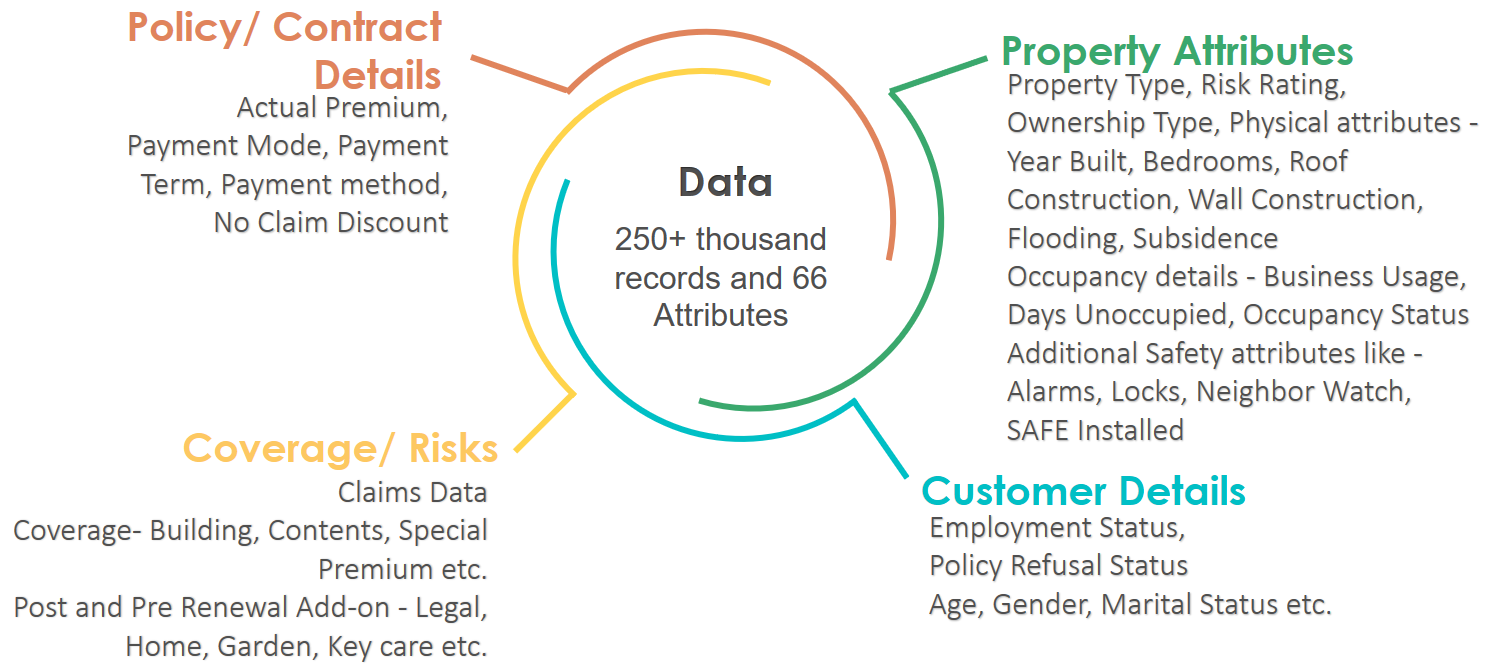

We analysed historical data from 1998 to 2011 for Home Owners Policies to build a model that can predict the likelihood of user accepting offered policy quote on renewal. The various factors influencing the premium like insured property attributes, Coverages, policy details such as premium, customer details, claim status etcetera were analysed.

Quote To Cash

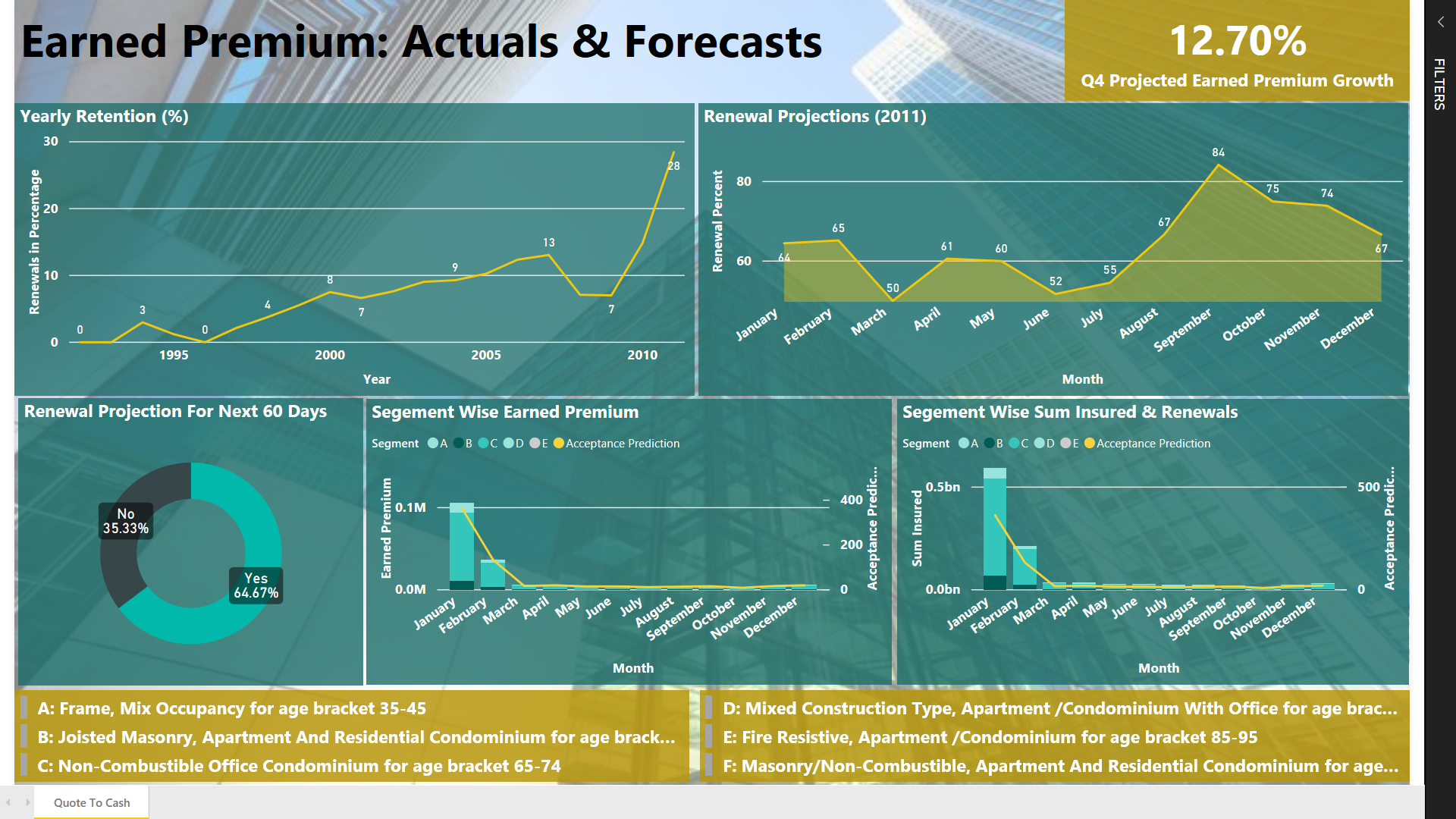

NIIT-Tech built a system to integrate the predictive model, that helps insurance company optimizing the price for individual customer based on his/her particular attributes, supplementing the classical rating structure.

The systems computes likelihood of individual accepting the offered price and provides the premium forecast for coming period. The insurer can define optimal price, within a range of reasonable prices, to increase insurer’s profits, or to increase the customer base, by retaining more current customers or obtain a greater share of new business. The goal of the Quote To Cash is to find premium level with the maximum likelihood of acceptance that will in turn maximize the revenue.

Instead of merely calculating a rate for a given class of insured based on the insurer’s internal data, largely driven by the losses, which we may term “traditional actuarial pricing”, system mathematically consider the expected likelihood of acceptance in response to proposed premium to be offered to the potential insured.

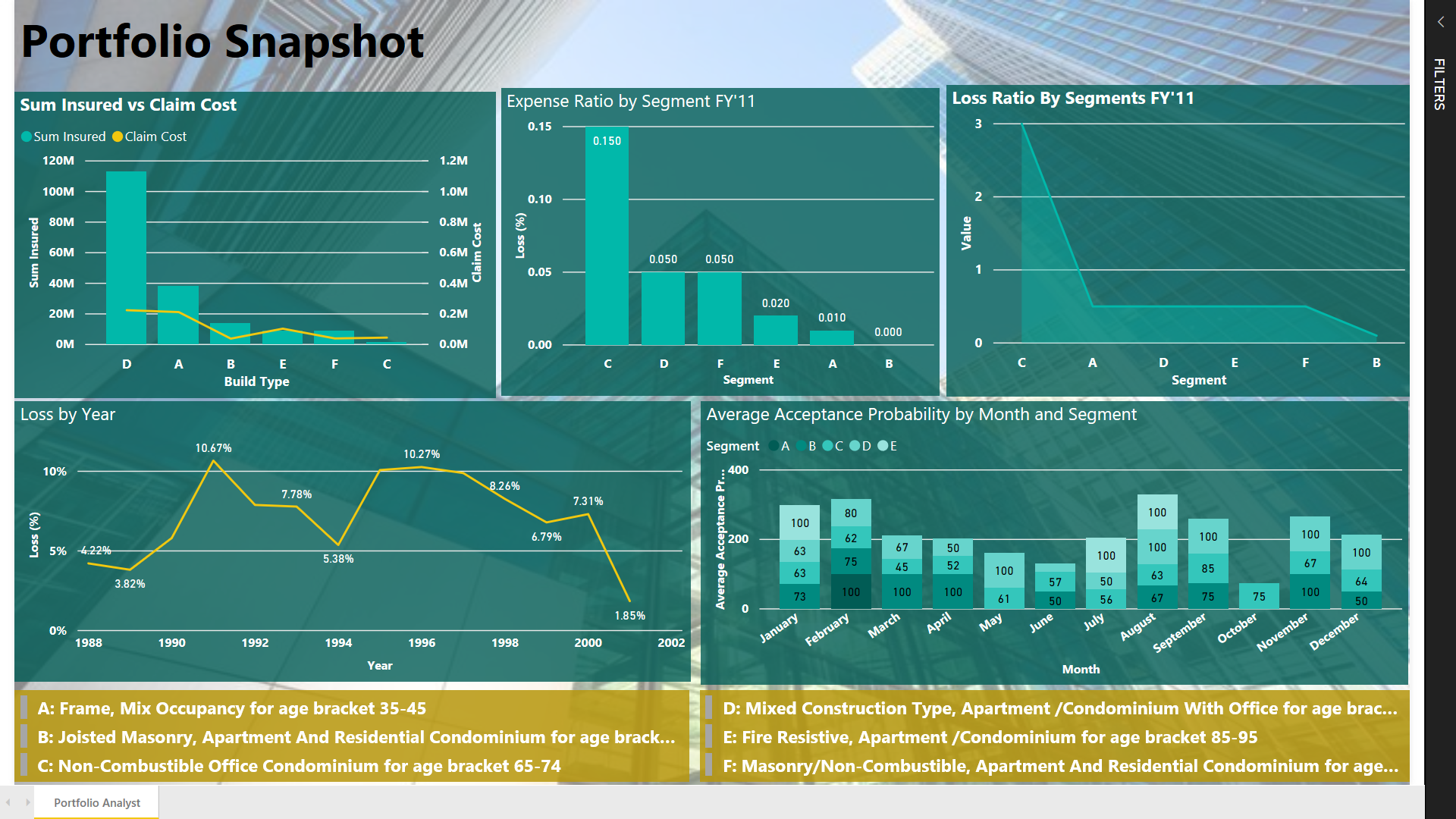

Portfolio Analyst

This can be achieved by identifying segments of portfolio based on profitability forecast of customers. Portfolio Analyst helps in identifying profiles that contribute positively to the portfolio and segregating segments which are under-priced based on their risk.

The segmentation solution provides view of the portfolio based on several parameters including expense, claims etcetera. It helps organizations to optimize their retention and acquisition strategy and is used to optimize pricing across portfolio.

Model Details

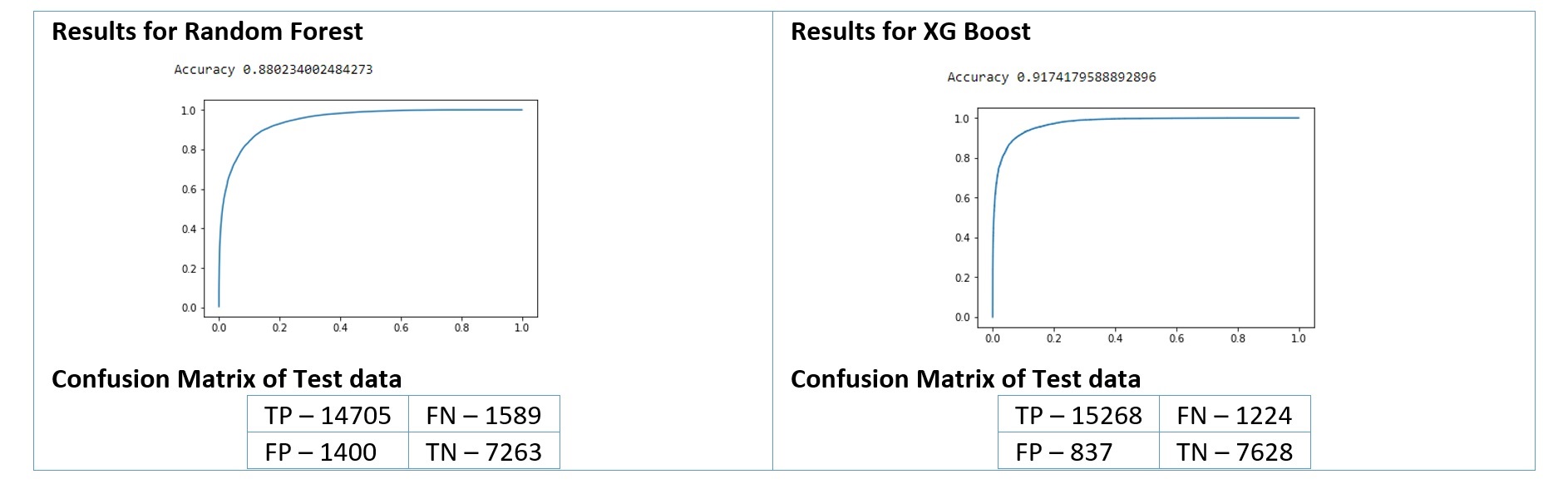

Algorithm Random Forest & XGBoost were used and finally results from XGBoost were utilized, which gave a higher 90% accuracy level. Overall for difference the difference between actual premium and predicted premium was very less, indicating that model is accuracy is good in most of the cases.