PRODUCT PRICING ANALYTICS

Trends in Group Insurance

Group insurance is rapidly becoming more customer-centric, and carriers who fail to recognize this will quickly fall behind. A dynamic approach is necessary to navigate the evolving insurance industry with observed trends:

Additional products and services to complement their core insurance offerings - customized health, wellness packages with additional perks or discounts.

Service both smaller business & enterprise organizations simultaneously will require adaptable business models.

Leave programs put significant burden on employers to manage eligible employees and their benefits.

Investing in robust technology solutions that are configurable to each unique offering, market segment, and region.

BUSINESS CHALLENGE

Insurance companies need to carry out a careful due diligence in pricing Group Insurances, because both under-pricing & overpricing can adversely affect the sales of the company. Under-pricing can lead to high loss ratios due to unprofitable sales & more claims and Overpricing can raise churn rate and impact customer base of carriers.

Thus, Accurate pricing of Group Insurance policies becomes highly critical for Insurance companies in order to have sustainable business with its customers.

PROPOSED SOLUTION

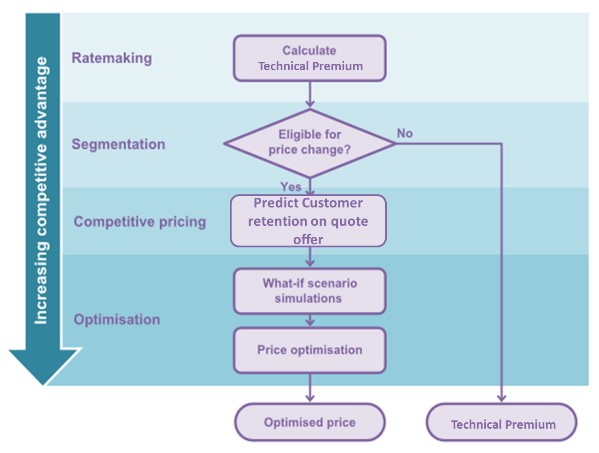

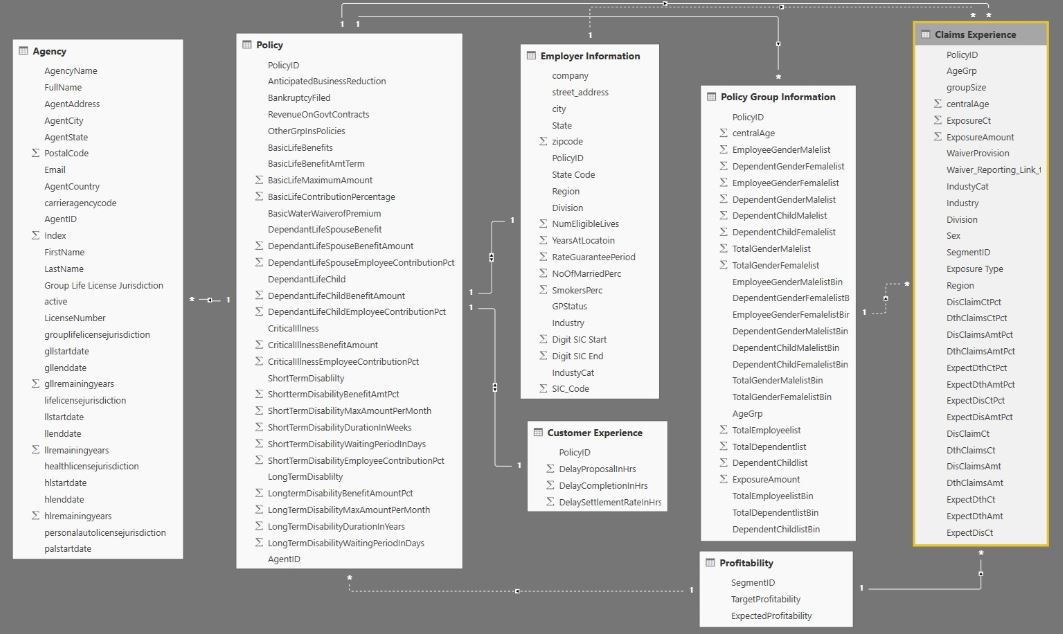

The group insurance sector has millions of data points for customer experience, demographics, agency information and others. Using this information, ML based classification model was built to predict the churn rate for old customers and conversion rate for new customer acquisitions.

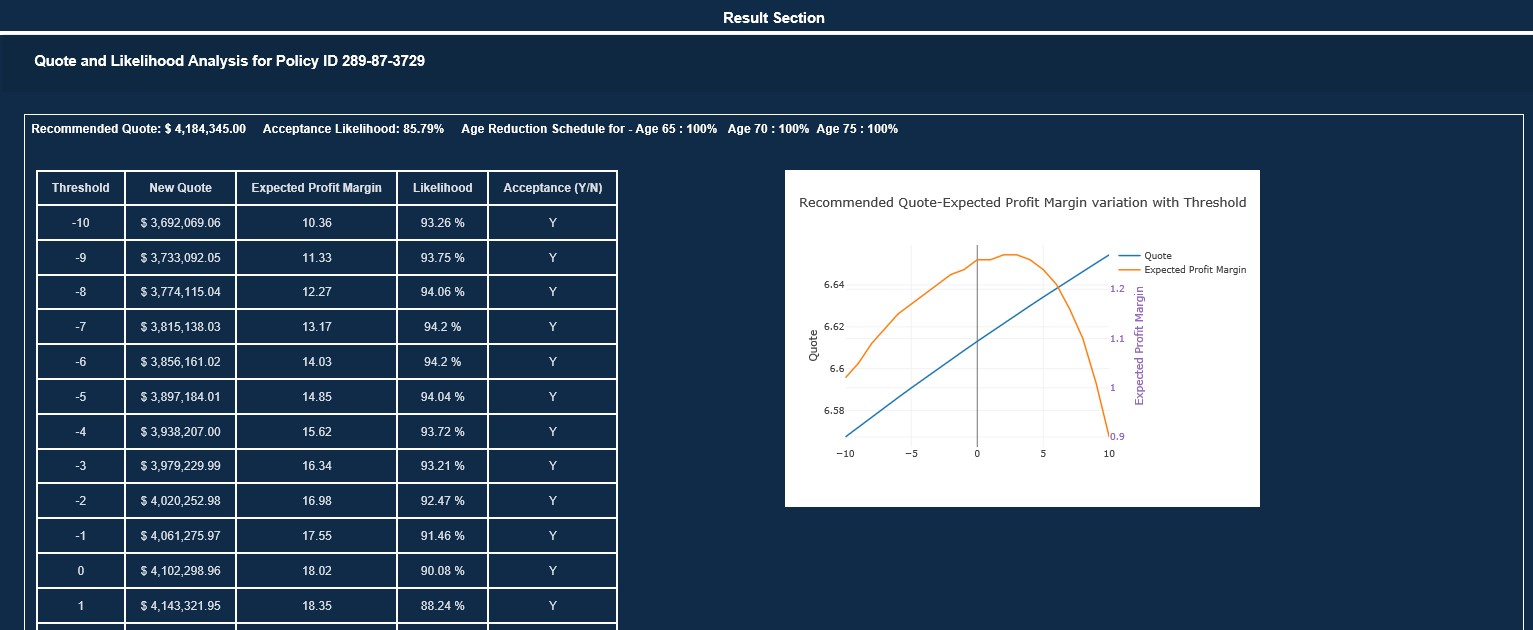

Price optimization model was then built post assessing the price tolerance at an individual policy level. This competitive model sets up the price, which maximises the profit from retained customers and optimal discount is computed to prevent the churn of customers. What-if scenarios were built so the maximum benefit can be extracted given the optimisation constraints.

MODEL DETAILS

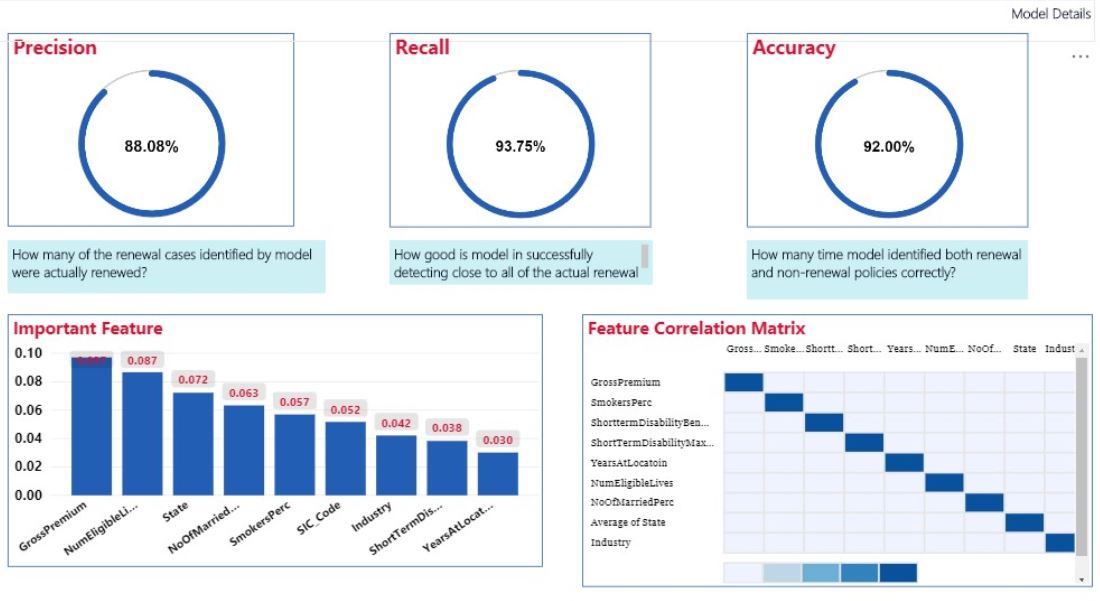

We analyzed the database of 1500 quotes with over 100 variables. Best model with maximum AUC and minimum log-loss was selected to predict the conversion class along their likelihood. In the pricing optimization individual quote optimization approach is followed, with assumption that individual quoted premium can vary between -20% and + 20% around the baseline. Based on the conversion probability, and thus the expected underwriting result we re - evaluates the profits choosing the individual customer’s premium variation to maximize the profit.

ALGORITHMS APPLIED

Algorithm XGBoost was used which gave a higher 92% accuracy level with precision of 88% and recall of 94%. Significant features were analyzed for better inference and insights for explaining what-if scenarios.

PORTFOLIO INSIGHTS

Portfolio was analysed to get insights for the policy status, geographic distribution, customer retention ratio and others.

AGENCY INSIGHTS

Policies can be explored with respect to the division of the agency and agent names. Exposure amount and count varies as per the geographic distribution and agent information.

CUSTOMER EXPERIENCE INSIGHTS

Historical data from past customer experience can also be analysed for delays in quotation, claim settlement and other processes.

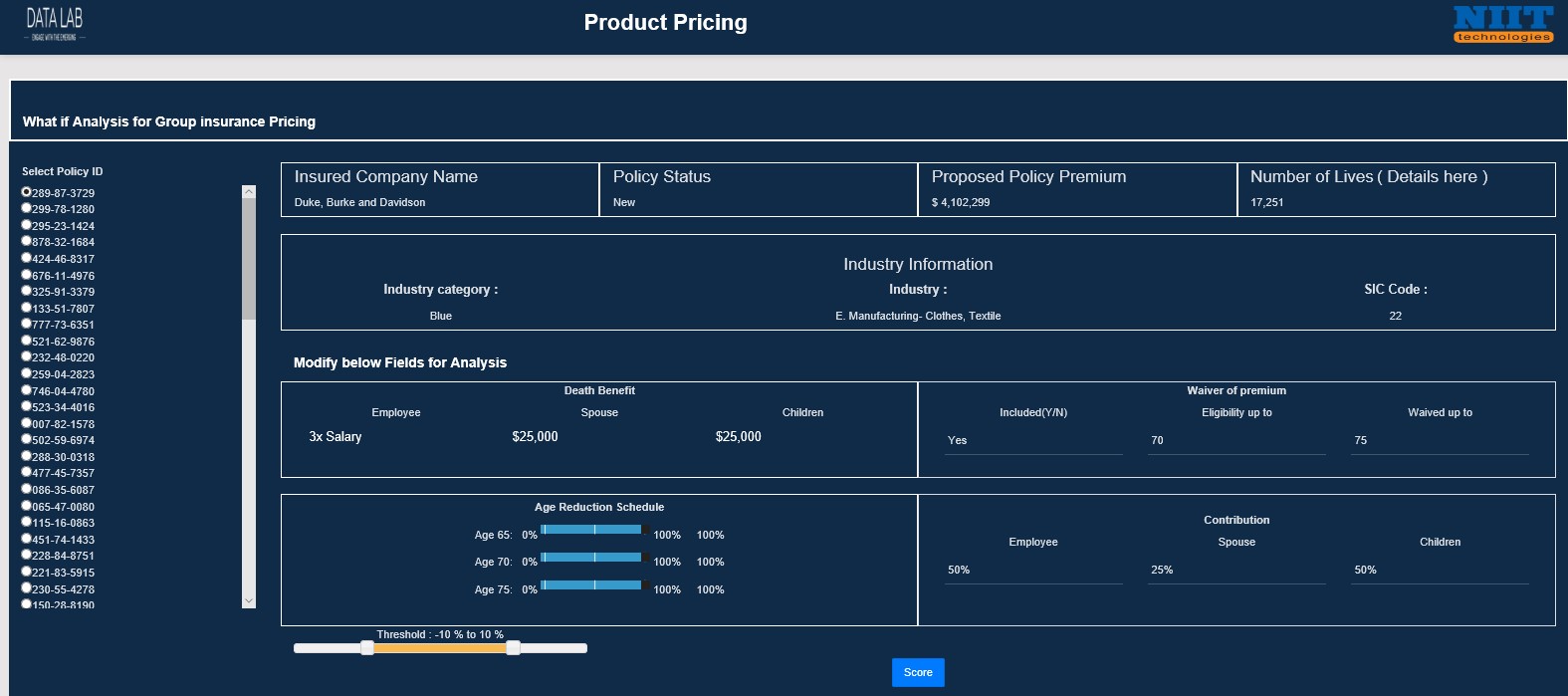

WHAT-IF ANALYSIS

Company information can be viewed for each of the policy id along with its current quote price. Significant predictors affecting conversion rates such as; Waiver information, Benefit amount, Age reduction schedule, employee contributions and slider to vary premium by +-20% are given for what-if analysis. Modifying these fields affect the quote and thus, optimal quote was recommended based on profit margin and likelihood maximisation.